Towards Naturalized Socioeconomics

The Model

The model is based upon General Systems Theory and the Epistemology of David Bohm’s Implicate Order. This is to produce the most complete and coherent socioeconomic system as practical

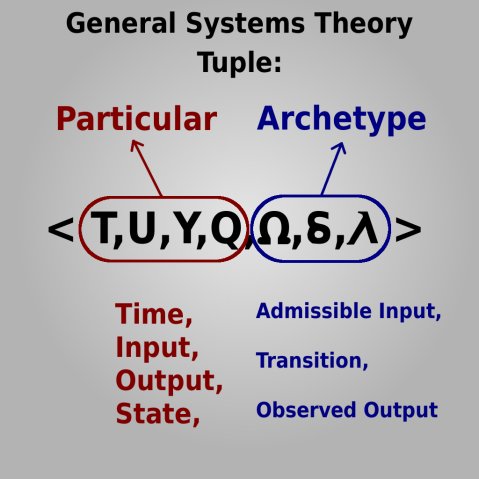

< T, U, Y, Q, Omega, delta, Lambda >

In the tuple above, the ( T, U, Y, Q, ) is the Particular portion of the mathematical framework for the model. It indicates interactions with and within the socioeconomic system. It represents time (T), input (U), output (Y) and state (Q). It denotes that input produces an output and results in a particular state over a certain length of time. The ( Omega, delta, Lambda ) is the Archetype portion of the mathematical framework for the model. It also indicates interactions with and within the socioeconomic system. It denotes that admissible input ( Omega ) through transition ( delta ) results in the observed output ( Lambda ). The Archetype functions as theoretical reference for the Particular which is the platform for practical application. The input ( U ) can be compared with the admissible input ( Omega ) to insure that the output ( Y ) results in the desired state ( Q ). The Particular also provides testing for the Archetype. Axioms provided in the admissible input ( Omega ) are tested in practice for refining theoretical value.

The Implicate Order was intended to provide the most coherent cognition as practical however the attention to “wholeness” could be extremely useful in modeling a socioeconomic system. The tendency to consider systems as fragmented hierarchies could result, and has resulted in considering them as closed systems contrary to the physical reality. Where all interactions are considered, there is minimized opportunity for unexpected outcomes. Where there is a pragmatic ( Omega ) the ( delta ) produces an ( Lambda ) that is as similar to expectation as practical.

To develop the Archetype, analyzing data sets for interesting relationships with cross disciplinary Inferential Statistics could produce the axioms for an initial hypothesis. The hypothesis is then tested by constructing business models in the Particular for practical application. The data that results feeds back into the Archetype to refine the axioms. This feedback loop begins the self-organization.

General Systems Theory and Economics

In trying to model a socioeconomic system that is generally coherent, General Systems Theory seems to be the obvious choice for a basis. A multi-disciplinary study towards the goal appears to be the route. The issues that we have faced with Socioeconomics has generally been due to either lack of understanding or more recently, lack of implementation. The accrued entropy has made the need for fundamental change not only more evident and accepted but also more dire. The attempts at developing contingencies have been a long line of partial solutions. Though at this stage such a change could produce large effects, it may still be too little too late.  General Systems Theory may provide a conceptual basis for a more coherent socioeconomic system. Realizing that socioeconomic systems are most likely to be coherent if they are inherently self-organizing systems, the model would require that particular property. This may be possible by modeling the system to be intrinsically dynamic, abstract and of course decentralized. This can only function properly if the inputs are considered with a high degree of coherence themselves. Rather than relying on the failed attempts at incentives that civilized society has defaulted to for thousands of years, mathematical attractors might be employed by the scientific disciplines that are relevant to the specific use case; be it Physical Science, Botany, Psychology etc.

General Systems Theory may provide a conceptual basis for a more coherent socioeconomic system. Realizing that socioeconomic systems are most likely to be coherent if they are inherently self-organizing systems, the model would require that particular property. This may be possible by modeling the system to be intrinsically dynamic, abstract and of course decentralized. This can only function properly if the inputs are considered with a high degree of coherence themselves. Rather than relying on the failed attempts at incentives that civilized society has defaulted to for thousands of years, mathematical attractors might be employed by the scientific disciplines that are relevant to the specific use case; be it Physical Science, Botany, Psychology etc.

The dichotomy of “Particular” and “Archetype” distinguish the theoretical (Archetype) and practical (Particular) usage of the tuple in the image above. The Particular represents the practical applications of the economic theory for business models and the Archetype supplies the modeler with axioms to ensure coherence in individual application. It’s important that admissible input (omega) be well researched across the relevant disciplines to ensure that the transition (delta) produce the intended observed output (lambda). This being the case, the input (U) can be checked against the axioms associated with the admissible input (omega) to ensure that the output (Y) brings about the desired state (Q).

Inclusion of all variables is extremely important due to the fact that there really are no closed systems. The fact the consideration of input and output relies upon a created boundary doesn’t suggest that it is an accurate representation of the physical state of the system. Entropy can more easily arise when variables aren’t accounted for as unexpected effects are likely whether or not the intended function exists. This doesn’t necessarily mean that destructive effects are probable in any certain instance; however they become more probable as instances accrue in multitude. Inclusion of as many variables as practical is essentially a preemptive solution to risk management in a more scientific sense.

Financial Incentives and Security (a rant)

Are there financial incentives to secure data and funds? In too many cases it’s not the case. When considering risk as possible loss of funds alone, one could expect that funds spent on security measures would be part of the equation. Another variable would be securities like insurance. The goal of course would be to get the smallest possible number as the yield. Negative numbers would be best.

It’s important to keep in mind that insurance is paid without exception; even if no losses are taken. This is the most common form of security. It doesn’t seem to be a stretch to suggest that insurance and network security are weighed by their ability to prevent overall interference with the bottom line. It’s trivial to find instances of huge losses accompanied with little to no security measures. In all cases this is covered by insurance.

So what is the financial incentive to secure funds? It’s an interesting question with a disturbing answer. This is because there are really no local incentives. They are primarily global in that they are based on the health and stability of the economic system. This of course is not a part of any entity’s bottom line. This is a “feature” and a function of the “Free Market”.

Businesses that handle data often try to secure it. For many this is their bread and butter; and since it’s often for sale, it makes sense to lock it up. This is especially the case if they are a high profile company. Possible loss of patronage would be a financial incentive to secure data and even funds in that case. This however is only the case if there are competitors to lose patrons to. The major ISPs really have no financial incentives to consider the wishes and / or needs of their patrons as they too often have no other choice.

The most disturbing scenarios are those instances where banks “suffer” heavy losses. The insurance company secures the funds whether or not the bank tried to. This however get’s worse. Stolen money is illegal money. In order for the thief to be able to benefit from the theft, the money must be laundered. Banks are known to launder hundreds of billions yearly; just to get it back into circulation. This is done by falsifying legitimacy and essentially buying it back at pennies on the dollar. How’s that for negative losses?

Now consider the incentive for securing the financial data on the proposed IOT refrigerator that orders food for you. Every bit of the disturbing scenario described in the previous paragraph could happen without your knowledge. Your account gets wiped out. The insurance covers it and the bank buys it back at pennies on the dollar. So one might suggest that it’s the lack of security that is the cause of the problem; however even if the company that produced the refrigerator is held at fault, their insurance still covers it. Revisit the second paragraph and consider the implications. It’s also important to keep in mind that the company that sold you the refrigerator likely has your and many others financial data; which makes them a viable target.

The most disturbing aspect of this all too common scenario is the flow of capital. In this ever more connected world, crises are poised to come more and more frequently. This is an implication of maximized consumption. This model should be expected to rapidly punch itself out. The “Internet of Things” under these conditions, as initial conditions is a stupid idea. The reason that it’s not seen by those who promote it, is because they are only considering their own bottom line.

At some point, the rapid concession of crises will promote fundamental change. Even with a socialistic solution such as Universal Basic Income, there will still be entities being fleeced by this exponential entropy. On a political note, the new Feudalism that David Brin warns of is a real concern. Saturated markets and very calculable, and finite consumer allowances would be fought over in the background. Maximization of profit would continue to aggregate markets and wealth to an unfavorable end. It’s a mathematical fact.

So what are the financial incentives for security? In the big picture, there are none; none at all.

Recent Comments